Capital gains tax. During the transitional period from 1 January 2022 to 30 June 2022 foreign-sourced income of tax residents remitted to Malaysia will be taxed at 3 on gross income.

Income Tax Malaysia 2018 Mypf My

With the Budget 2019 the RPGT for disposal of real estate from the 6th year of ownership onwards will be increased.

. Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia. The personal income tax with the highest rate is only 27. It should be noted that this takes into account all your income and not only your salary from work.

Calculations RM Rate TaxRM 0 - 5000. This means that low-income earners are imposed with a lower tax rate compared. On the First 5000 Next 15000.

Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. Malaysia Personal Income Tax Rate. Inland Revenue Board of Malaysia 10Y 25Y 50Y MAX Chart Compare Export.

Calculations rm rate taxrm a. Malaysia Personal Income Tax Rate The Personal Income Tax Rate in Malaysia stands at 30 percent. Assessment Year 2019 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income.

It should be noted that this takes into account all your income and not only your. Resident nationals and foreigners. Download Kwsp Income Tax Relief 2019 Gif.

Malaysias finance minister presented the 2020 Budget proposals on 11 October 2019 and announced an increase in individual income tax rates by 2 percent. 22 October 2019. No tax is payable if total income under salaries does.

Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the same no matter the amount of income. Tax Rate of Company. On the First 5000.

Increase to 10 from 5 for companies Increase to 5. Income Tax Malaysia 2019 Calculator Madalynngwf Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a. Introduction Individual Income Tax.

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News 10 Things To Know For Filing Income Tax In 2019 Mypf My. Review the latest income tax rates thresholds and personal allowances in Malaysia which are used to calculate salary after tax when factoring in social security contributions pension. Personal Income Tax 20182019 Malaysian Tax Booklet 23 An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect.

On the First 20000 Next. This translates to roughly RM2833 per month after EPF deductions or about RM3000 net. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable.

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金 Map Screenshot Map Periodic Table

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Income Tax Formula Excel University

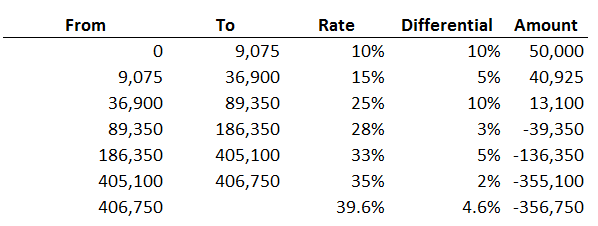

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Income Tax Formula Excel University

Income Tax Formula Excel University

Income Tax Formula Excel University

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Individual And Corporate Tax Reform

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Income Tax Formula Excel University

Relief Options For Current Year Unabsorbed Capital Allowances And Trade Losses Acca Global

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)